By Marla Martin

Florida’s housing market continued to report more closed sales, higher median prices, more new listings and increased pending inventory compared to a year ago, according to Florida Realtors® latest housing data. Note that this month’s May 2020 comparison data reflects the state lockdown and economic uncertainty that occurred last spring during the coronavirus pandemic.

“In May, Florida’s housing market continued to show strong year-over-year gains,” said 2021 Florida Realtors President Cheryl Lambert, broker-owner with Only Way Realty Citrus in Inverness. “Of course, in May 2020, Florida remained under lockdown and was feeling the effects of the pandemic. Median prices continue to rise: Part of the reason is that the state is experiencing a greater share of luxury sales in 2021 compared to a year ago, but overall home price appreciation is also a big factor pushing costs higher.”

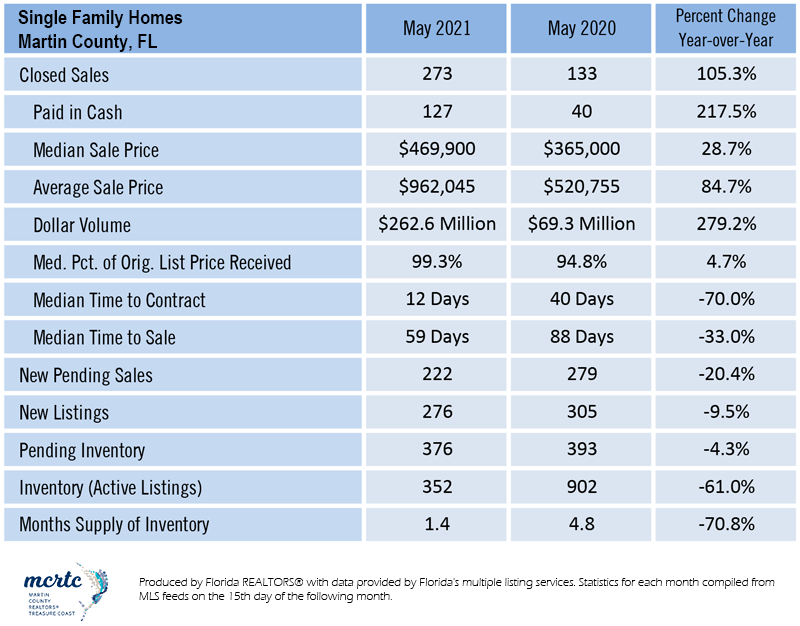

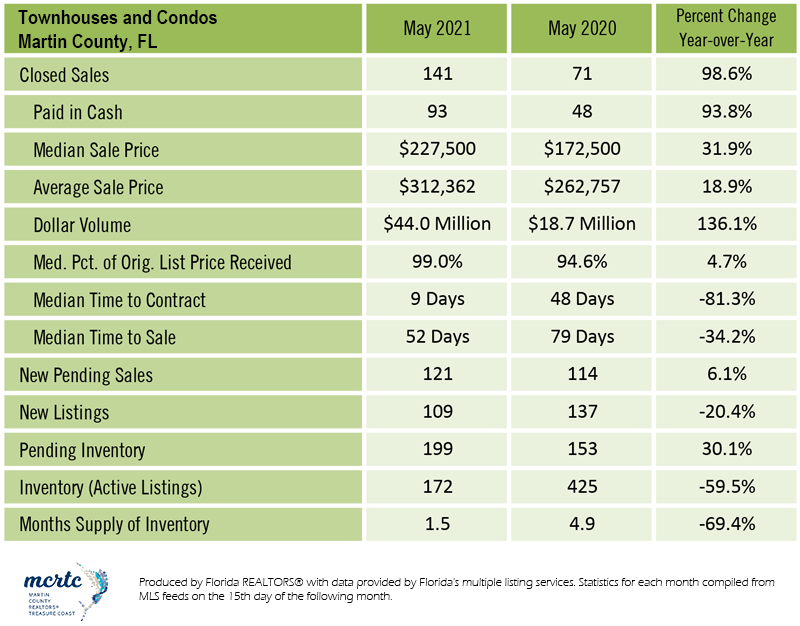

In Martin County, the increase in number of closed single-family homes increased 105.3% as compared with May 2020, and the Median Sale Price of $469,900 is a 28.7% increase as compared with last year. Inventory is down 61%, reflecting the high-demand of property in our area. The condo-townhouse market also saw a 98.6% increase in number of closed sales in May 2021 as compared with May 2020, and the median sale price is up 31.9% to $227.500. Inventory of this type is also down by 59.5%.

Closed sales of single-family homes statewide in May totaled 30,985, up 57.9% year-over-year, while existing condo-townhouse sales totaled 15,491, up 155.2% over May 2020. Closed sales may occur from 30- to 90-plus days after sales contracts are written.

The statewide median sales price for single-family existing homes was $344,900, up 27.7% from the previous year, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month’s statewide median price for condo-townhouse units was $250,000, up 24.1% over the year-ago figure. The median is the midpoint; half the homes sold for more, half for less.

May’s housing data offered insight into market trends, according to Florida Realtors Chief Economist Dr. Brad O’Connor.

“Florida’s inventory of existing single-family homes listed for resale increased slightly over the course of the month, rising from 31,618 as of the end of April up to 32,021 by May 31,” he said. “While that’s only a little over a 1% increase, it’s significant because this is the first time Florida’s single-family inventory has increased during any month since March of 2020. It comes on the heels of only a very slight month-over-month statewide decline of just 40 single-family active listings (inventory) from March to April. So that’s two consecutive months where the state’s single-family inventory has been relatively stable.

“Of course, we are still down 58.2% compared to a year ago, so we are by no means out of the woods in terms of the housing shortage – but we can at least take this flattening inventory curve as a sign that we might finally be at the start of a long march back toward a balanced market.

O’Connor explained one reason the decline in single-family inventory appears to have stopped is that the number of existing homes being listed for sale each month generally continues to be in line with recent historical norms prior to the pandemic.

“During May, 34,298 single-family homes came onto the market, which is only 179 fewer new listings than in May of 2018, and just 212 more than May of 2019,” he said. “At the same time, the number of single-family homes going under contract each month, which has been well above historical pre-pandemic norms since June of last year, has been slowly but surely trending back toward those norms in each successive month of 2021.

“This reversion toward historical norms in the level of contract signings is a strong indicator that monthly counts of closed single-family home sales will also move back toward more normal levels, and this appears to have started in earnest in May.”

On the supply side of the market, inventory (active listings) remained tightly constrained in May. Single-family existing homes were at a very low 1.1-months’ supply while condo-townhouse inventory was at a 2.0-months’ supply.

According to Freddie Mac, the interest rate for a 30-year fixed-rate mortgage averaged 2.96% in May 2021, down from the 3.23% averaged during the same month a year earlier.